Become an mdrt (million dollar round table) Member

Professionals in Life Insurance: MDRT

THE PREMIER ASSOCIATION OF FINANCIAL PROFESSIONALS:

MDRT is a global, independent association of the world’s largest life insurance and financial services professionals from more than 500 companies in 70 countries and territories. MDRT members demonstrate exceptional professional knowledge, strict ethical conduct, and outstanding client service.

MDRT membership is recognised internationally as the standard of excellence in the life insurance and financial services industry. MDRT membership provides access to a full spectrum of forums that help members increase their productivity and professionalism.(mdrt.org)

Through MDRT, the MDRT Academy and MDRT Global Services, helps the best and brightest elevate of Your success, build a community of excellence, and live rich and meaningful lives. Throughout your career, MDRT will be there.

LIFE PLANNER:

A LIFE PLANNER is a technical expert who is skilled to help individual clients meet their financial goals. A Life planner undertakes a detailed analysis of his client’s current and future financial needs and evaluates them, determines their risk profile, and assesses their current income. He then combines all the information gathered and assists clients in charting out a customized financial plan for themselves.

Financial planning by a Life planner includes – Investing, Risk Management, Estate planning, Retirement Planning, Tax Planning etc.

The total mortality protection gap in India stands at $16.5 trillion (as of 2019) with an estimated protection gap of 83% of total protection need. Life Insurance operators can have the opportunity with an estimated additional life premium opportunity of average $78.2 billion annually over 2020-30. (Source-The journal Insurance Institute of India)

India’s mortality protection gap stands at $16.5 trillion.

The retirement funding gap is expected to reach $85 trillion by 2050, at a CAGR of 10%.

India has one of the highest and fastest growing mortality protection and retirement funding gaps in the world. These dual challenges provide life insurers a significant multi-decadal growth opportunity. These structural growth drivers should ensure that the life insurance sector will continue to deliver over 15% total premium CAGR in the next two decades. The combination of brand and distribution reach, coupled with innovations in offerings, should help large private players continue to gain market share with better profitability as the benefits of product mix changes kick in. (Source-Financial Express)

Earn more by doing customer’s financial planning:

1. Balance cash inflow and outflow for customer’s comfortable life

2. Ensuring customer’s financial independence after retirement

3. Help customer to manage a financial emergency

4. Guide customer how to reduce tax liabilities

5. Help customer to accomplish money goals

6. Guide customer about Investments for wealth creation

7. Discuss Incorporate risk management strategies and insurance

8. Retirement investment

9. Space to review the financial plan and make changes

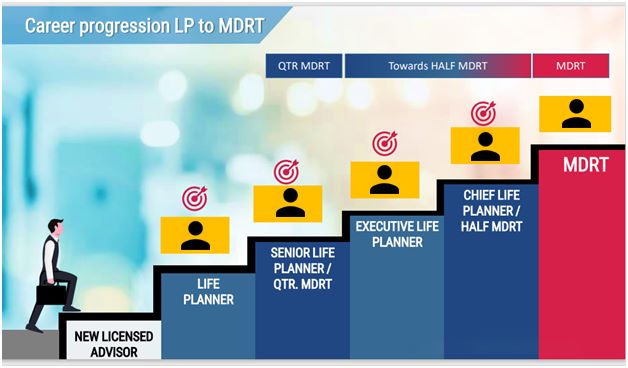

Career Path

TATA AIA LIFE INSURANCE COMPANY LIMITED is dedicated to providing our life planners with a highly rewarding and self-fulfilling career full of NEW OPPORTUNITIES.

We lead our LIFE PLANNERS to excellence, accelerating their path to an MDRT membership.

JUMP START YOUR CAREER AS A LIFE PLANNER

Talking about a career in the insurance industry – The sky is the limit. There are endless possibilities for you to make it big while selling insurance.

A Life Planner is not just convincing people to buy insurance. He is helping people reach a state of complete security that leads to a peaceful living experience.

You are building a relationship on the values of trust, hope, and dreams for a safe future.

There is no fixed formula for a Life Planner to achieve an exceptional conversion rate. However, there are certain traits common in most of the Life Planners who emerge as star players. These are the habits that separate a successful Life Planner from the ordinary.

CONSISTENCY IN THE FOLLOWING HABITS WHICH MAKES THE DIFFERENCES

- Create Daily Routine: Charting out the day’s schedule in the morning gives clarity of work and increases productivity.

- P & D Method: Prioritization and delegation of tasks according to their order of importance.

- Manage Stress: Adopt healthy measures for stress management.

- Set & Track Goal: Setting up a target & periodic tracking of goals to further work accordingly.

- Surround Yourself With Positive People: Be in the company of positive people who motivate to work better. Share thoughts and take guidance.

- Rapport Building: Build a good rapport with everyone they meet.

- Continue Learning: Update their knowledge through tutorials, webinars, conferences, reading books etc.

- Work on their Soft Skills: Analytical thinking, Communication and logical reasoning.

- Adopt Today’s Power: Learn new technology that helps to ease out their work.

- Dress Professionally: Work on their dressing and appearance to look more confident and presentable.

- Watch Your Tongue: Use respectable language and professional jargons.

- Grab The Roots: Quickly discover a common ground in conversations and take the connection to another level.

- Proofread all written documents: Make sure all your customer communication materials are well written and proofread for making your catch strong. Otherwise it will end up ruining your trust and credibility.

- Rectify the mistake: Record Yourself Talking to Clients, Practice makes perfect and if you know where you’re making mistakes, you can easily rectify them.

- Don’t Forget the Fundamentals: Remember you are in sales, your job is to educate the prospects about the product and sell them the most suitable policies for their needs.

- Be Attentive: Concentrate more on listening to your customer and their grievances.

- Work Hard: Read more books, brush up your knowledge & skills, work harder, then you’ll find that the sales process had become easier. Now it seemed to have a walk in the park.

- Making the Link: Asking questions makes clients feel as you really care about and are not just making a sale. This makes them more intend to buy from you.

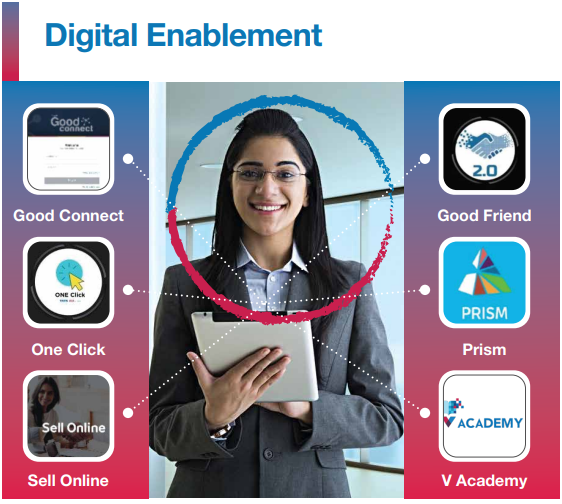

Digital Marketing Tools, Enhancing the Sales

Digital marketing tools, today, basically function to broaden your reach to more and more people with minimum effort of reaching out to them.

These tools have brought a positive impact on the efforts to convert insurance sales as well. Reaching potential customers has now become a much easier task than before. Send bulk emails, messages, and reminders all using digital marketing tools from the comfort of your home. This not only increases your online presence but also helps you showcase your insurance product in more colorful and creative ways which remains in a client’s head longer.

.

Social-media marketing tools:

Social Media marketing is one of the most dynamic tools in the digital marketing space. Also highly useful for our LIFE PLANNER. Let us look at a few tools which can be used:

Email: Marketing done through e-mail means sending bulk emails to potential as well as all current clients. This tool is very effective when you want to announce or introduce something to everybody in general. Like introducing a scheme or announcing new premium rates.

Video Call: Video calling has gained momentum after the pandemic. Clients now understand that there is not much difference in meeting the LIFE PLANNER in person or through a screen. Video calls give the client a personal touch and also builds a good rapport as though the person is in front of you. Examples: Google meet, Zoom, Microsoft Teams

Meeting Scheduler: Meeting scheduler is a digital tool that keeps track of your entire schedule. These organizers help greatly in cluster management while help you remember all your meetings and deadlines. Meeting Schedulers are extensively used for sales presentations, policy review meetings and team meetings.

Search Engine: A search engine gives you plethora of information about any topic you wish to acquire knowledge on. Quick real time data helps you convert your sales call like cake-walk. Example – Google, Microsoft Edge